Launching Kroo

Context

Our mission: Change the relationship people have with money for good*

*For you, the planet, forever

I joined Kroo Bank as employee #8 and designer #1. Over my 4 years at Kroo, we took an idea of ‘changing the relationship people have with money for good’ through to a fully regulated bank in the U.K as of June 2022.

Kroo (formerly B-Social) startup venture began as an MVP exploring the hypothesis of combining your social and financial worlds, and removing the social awkwardness of money.

However, as the company progressed towards attaining a banking license from the Bank of England, our challenge grew to evolve the product into a fully-fledged personal current account, that could grow and scale as the bank did.

My contribution

Branding, UX Design, Research, Prototyping, Usability Testing, Visual Design

1x Product Manager

2x Product Designers

6x Engineers

The team

Tools

Figma, Adobe Suite, Usertesting platforms, Principle

The problem

Building conviction in problem/solution fit

Our customer research had given us high confidence that our problem space existed: the awkwardness around social and financial sharing among friends. Our market research had shown there was a gap in the market for a ‘social’ bank. We had many ideas for how the problem could be addressed, but needed to test our ideas to build confidence.

The approach

Understanding: What do people need from their bank?

I ran a series of workshops, interviews, surveys and sketching exercises on a range of topics covering: challenges and frustrations they face with their current banking, what delights them, baseline expectations, and what would make them change their current bank provider. This helped inform prioritisation of new features, a backlog of Big Bets to test, and later inform a new app architecture.

Research methods

Market research, consumer analysis & competitive landscape

User interviews (qualitative) & surveys (quantitative)

Card sorting sessions to inform the new information architecture

Prototyping & usability testing with core target market

The approach

Customer-centric, lean design

We put users at the heart of our experience design, across the product lifecycle.

Using lean practices, such as paper prototypes and low-fidelity wireframes, we tested multiple user journeys and screens to increase confidence in our designs early — starting with key user journeys such as onboarding, adding money to their account, and activating their debit card.

We continued to test early and often through our delivery, and get feedback on features rolled out to our soft-launch customers.

The approach

Launch a Minimum Viable Product

To rapidly test problem solution fit and gain confidence in our hypotheses of blurring financial and social worlds, a MVP (B-Social) was quickly built and soft-launched to early adopters. Soft-launch customers could create social groups, spend, track and settle up with friends all in one place on the B-Social app, and spend on a prepaid debit card.

This enabled us to quickly build, ship, and iterate product ideas and run lean experiments to evolve our product solution.

B-Social — MVP Product

B-Social — MVP Product

The approach

Flexible, scalable Kroo Information Architecture

As a potential banking license drew closer, it was clear the MVP product was not able to support the many requirements and features needed to become a legal bank. In addition, the more we learned about our customers from B-Social, the more potential we saw for innovative product ideas to truly disrupt traditional banking.

Our existing Information Architecture was unable to accommodate the long list of requirements from the regulator & Bank of England in order to be deemed a current account and granted our banking license (such as Overdrafts, Direct Directs, Standing Orders, Open Banking capability and a number of security requirements). It was also not flexible enough to adapt to new product functionality identified in the user research sessions, or from our customers in the future.

To address this, I ran a number of sessions with the design team and key stakeholders to develop an architecture that could adapt and scale with the business requirements, and did multiple rounds of user testing to validate.

The approach

Refreshing the Kroo visual identity

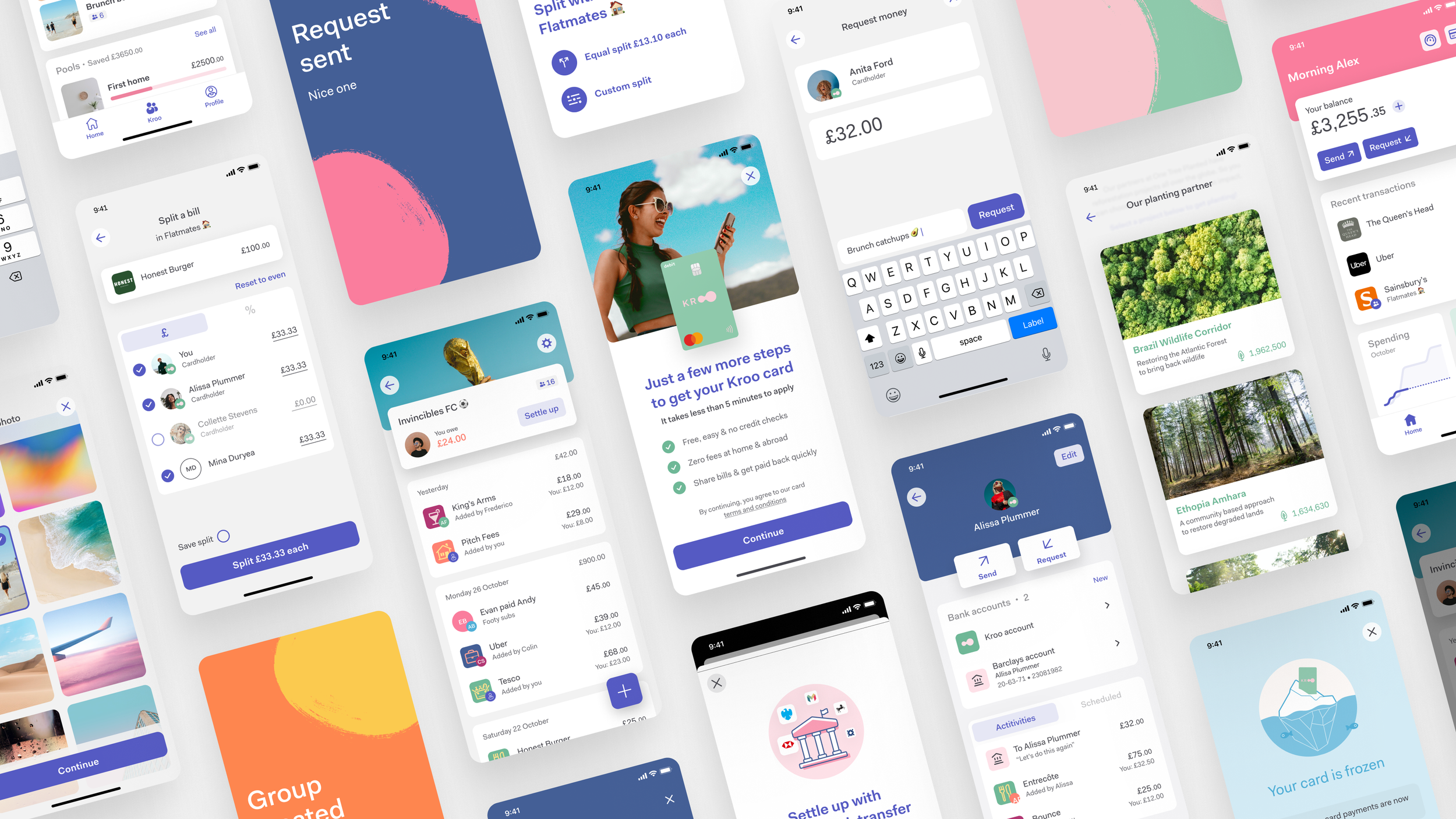

With a fresh name change and rebranding process from B-Social to Kroo (see case study) we bought the app to life by applying the new Kroo branding in an iterative, continuous-design approach — incrementally applying the new branding as product features were built, and continuously building out our atomic design system library.

The outcome

Increased customer retention, engagement, reviews…and a fully-regulated Bank

The Kroo product is flexible to address the evolving regulatory requirements, adaptable to customers’ ever-evolving needs, provides a delightful user experience, and ultimately reflects the startup’s vision to become ‘the world’s greatest social bank’.

The refreshed Kroo app launched to the UK public in 2022 to 10,000 customers, scaling to 150,000+ within the first year.

Our NPS, Trust Pilot reviews, and customer retention rates all saw significant improvements after the Kroo app refresh. Kroo reached #1 on App Store for Finance apps shortly after public launch.

In July 2022, we were granted our Banking License in the UK — the only bank to be granted one since Monzo (2017).

Our first crowdfunding sold out within 2 days, and our Series B funding round has raised £26M.

Kroo was awarded Best Banking Newcomer in 2022 & Best Banking Innovation in 2022, 2023.

Today, Kroo continues to gain market share and evolve its customer-centered product offerings.